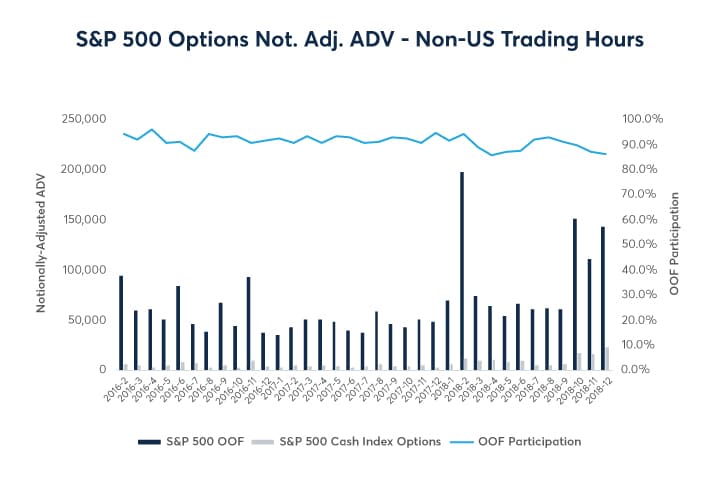

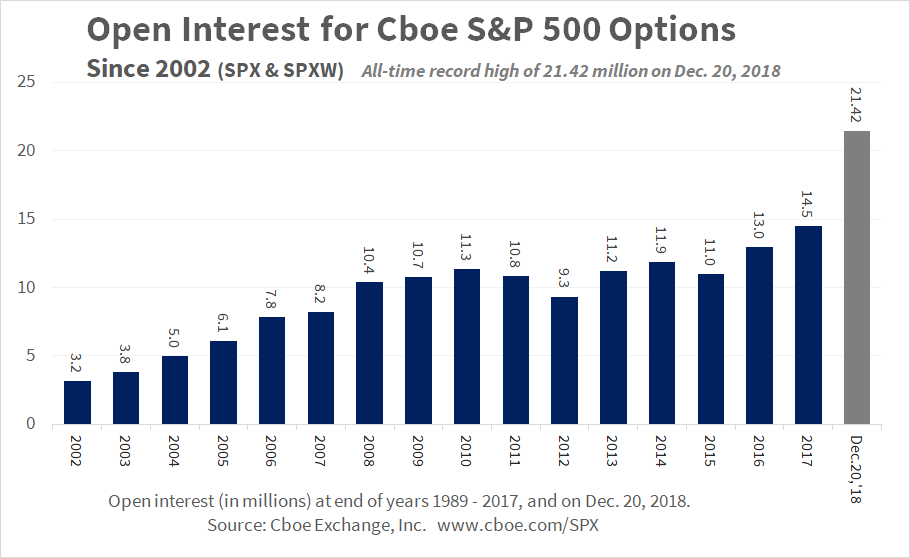

New All-Time Record – Open Interest for Cboe S&P 500 Options Surpasses 21 Million Contracts – Indexology® Blog | S&P Dow Jones Indices

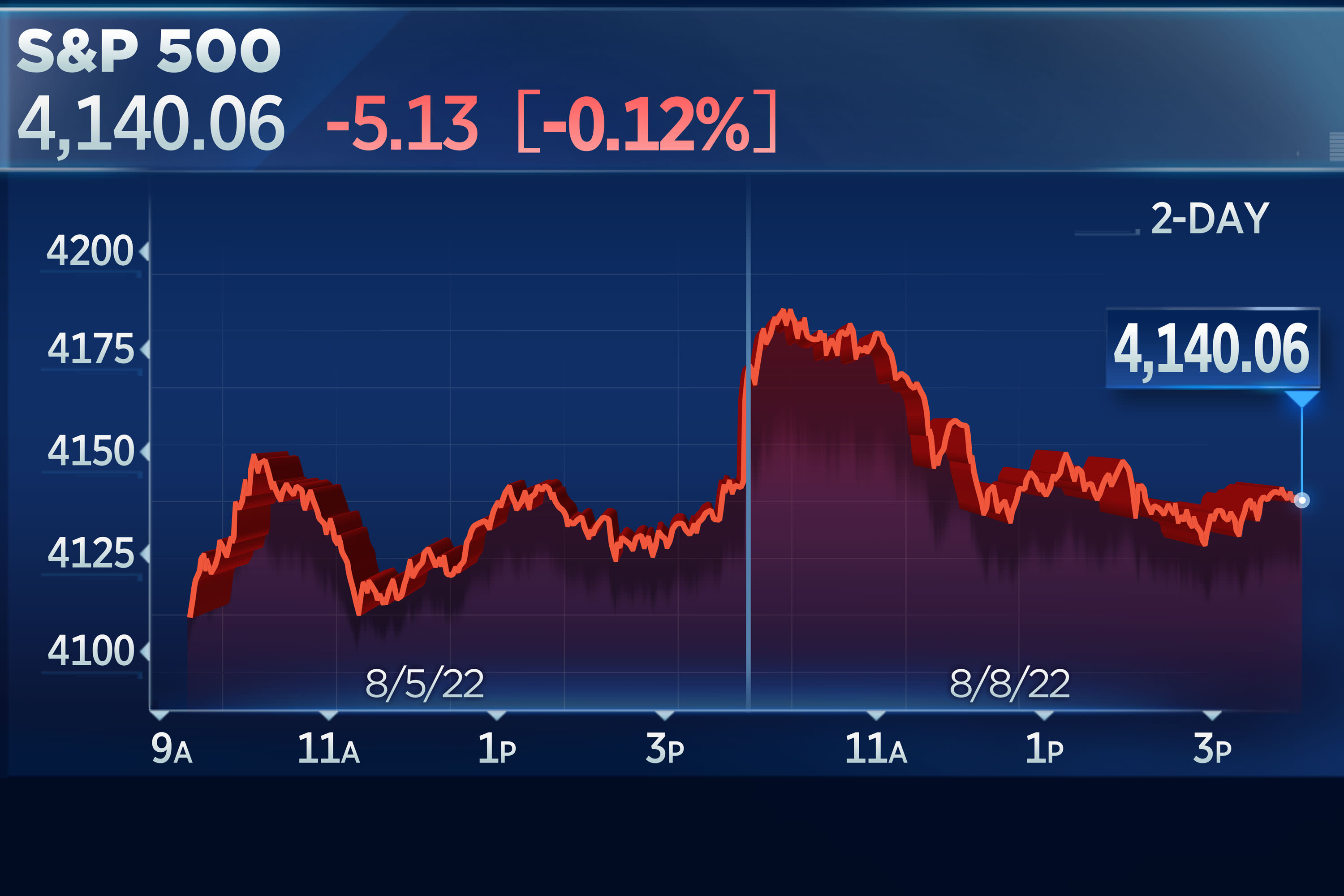

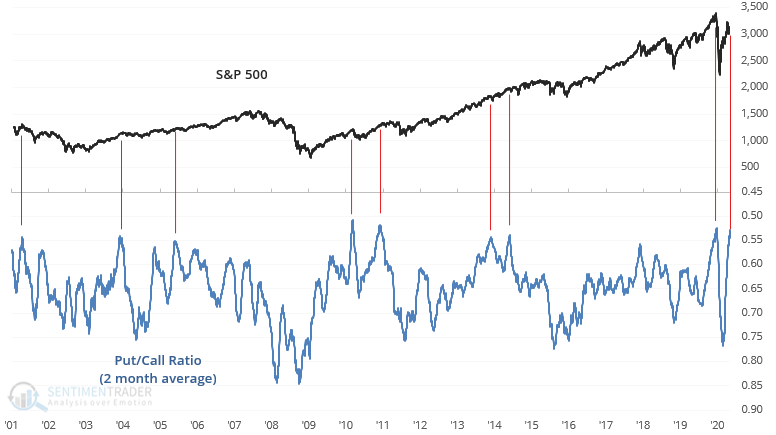

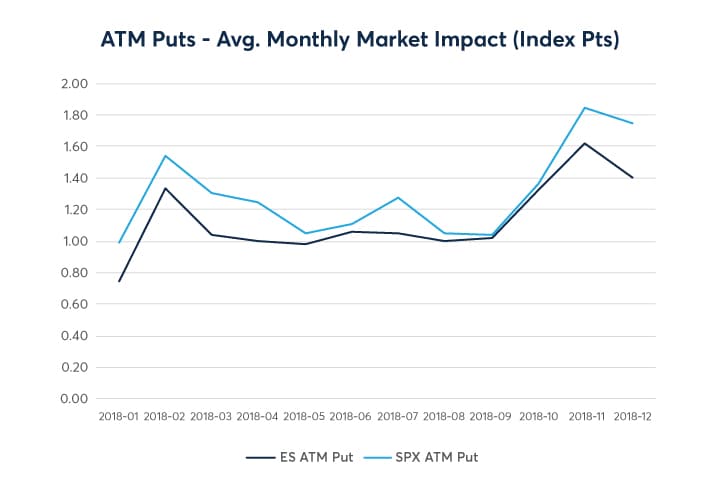

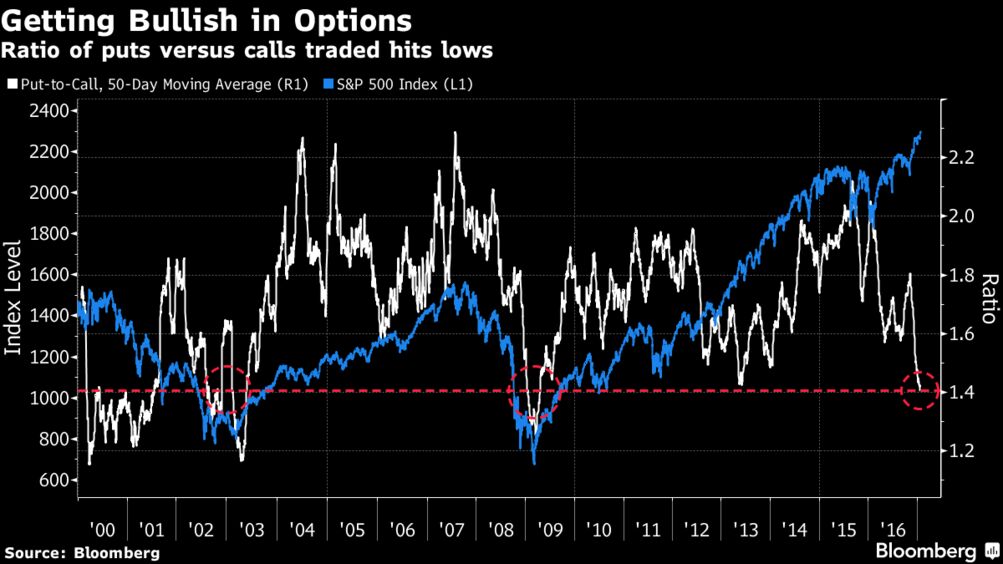

S&P 500 (SPX) Put/Call Ratio Is Record Low, but Dark Pool Buying Activity Has Been Slowed Down Which Might Cause a Bearish Trend

![Put/Call Ratio [ChartSchool] Put/Call Ratio [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_indicators:put_call_ratio:pcr-7-cpcsmooth.png)